A Plan for Growth: Clarington's 2024-27 Budget

On January 15, 2025, Clarington's 2025 Budget Update was deemed adopted, following Council's consideration and amendments. Read the press release.

The Municipality of Clarington’s 2024-27 Multi-Year Budget outlines the Operating Budgets for the four-year period. Each year, the Municipality reviews and updates its Multi-Year Budget (as required under the Municipal Act, 2001).

Annual updates to the four-year budget provide flexibility to address changes in circumstances or special events that require funding or resource adjustments. It’s about responsible fiscal planning while remaining flexible and adaptable to a changing environment.

As Clarington continues to grow, we are committed to delivering meaningful municipal programs and services to best serve our community. Clarington is committed to a collaborative, responsible budgeting process, supporting the delivery of the Clarington Strategic Plan, to ensure our business operations are aligned with the priorities identified by the community.

Read the 2025 Budget Update* Read the 2025 Budget Addendum

Read the 2024-27 Multi-Year Operating Budget

* The 2025 Budget Update document is being updated to reflect Council's amendments. This will be published in the near future.

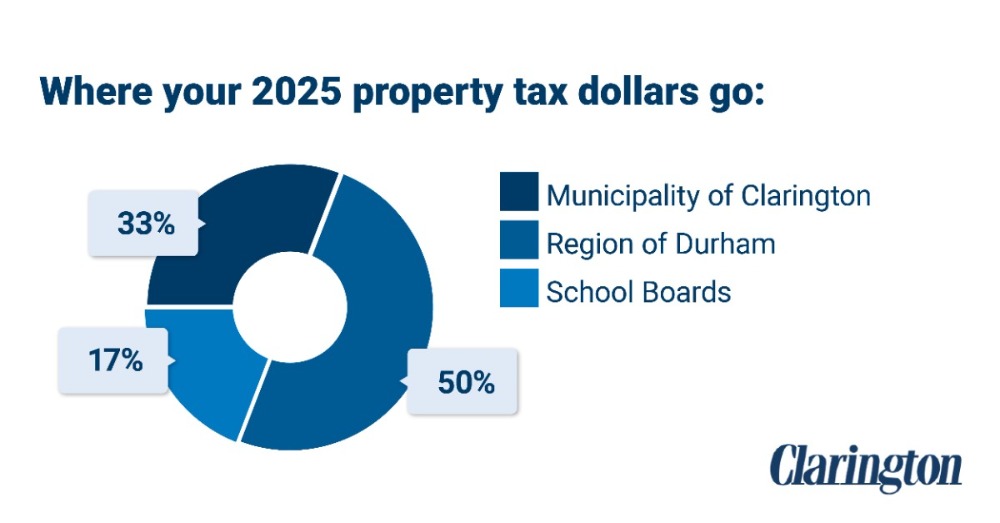

Clarington’s portion of your tax bill is 33 per cent of the total amount you pay. Fifty per cent goes to the region of Durham and 17 per cent funds education.

2025 Tax Levy

Clarington’s portion of a homeowner’s tax bill supports a wide range of services, including local road maintenance, recreation facilities and programming, libraries, parks and fields, municipal law enforcement, fire and emergency services, economic development, building inspection, local planning and capital investments in our community.

Clarington’s proposed 2025 Budget includes a net levy increase of approximately $93 for the average household, or about $7.78 per month. Read the 2025 Budget Update to learn more.

2025 Budget Highlights

Capital investment highlights for 2025

- Breaking ground on the South Bowmanville Recreation Centre

- Outdoor skating rink at Diane Hamre Recreation Centre

- New Operations Depot, Fire Station and Training Centre for Public Works and Clarington Emergency and Fire Services.

- New library book vending machines in the community

- Upgrades and improvements to Longworth Park, Brookhouse Parkette, Pearce Park, Lord Elgin Park, Newcastle Waterfront Park and Bowmanville Memorial Park; tennis court upgrades at Solina Park

- Splashpad resurfacing at Harry Gay Park and Longworth Park and reconstruction at Westside Drive Park

- Bridge, trail and road rehabilitation throughout the Municipality

- Building improvements to the Bowmanville Library

- Interior improvements to Garnet B. Rickard Recreation Complex, Fire Station 3, Courtice Community Complex, South Courtice Arena

Operating investment highlights for 2024-27

The budget is reviewed and updated annually to reflect an update in community needs. Changes for 2025 of the current four-year budget are brought forward to provide flexibility to address changes in circumstances, such as a change in legislation, or special events, such as new grant availability, that require funding or resource adjustments. Here are some highlights for 2024-27:

- Delivering meaningful municipal services to the community, including snow removal, fire services, by-law enforcement, recreation programs, and the ongoing maintenance of roads, sidewalks, trails, parks, sports fields, facilities and more.

- Using technology and process improvement initiatives to modernize and optimize services by undertaking continuous improvement projects across the organization.

- Enhancing the delivery of emergency and fire services across the community by hiring 20 firefighters in 2025 to place an additional full-time truck into service, and increasing minimum staffing per truck from three to four personnel at Station 4 in 2025, and at Station 2 in 2026.

- Providing funding support for a variety of external agencies to deliver programs and services for the community, including The Visual Arts Centre of Clarington, the Firehouse Youth Centre, Community Care Durham, Bowmanville Older Adults, Charles H. Best Diabetes Centre, Newcastle Community Hall and Lakeridge Health Foundation.

- Improving the development approvals process to efficiently support and invest in the creation of housing for the community.

- Implementing the Parks, Recreation and Culture Master Plan to best meet Clarington’s current and evolving recreational needs.

- Conducting a forestry review and investing in forestry services to improve the tree canopy.

- Developing and beginning implementation of the Active Transportation Master Plan and Wayfinding System Strategy, which will support Clarington's vision for a safe, integrated, and cohesive transportation network for all modes of active travel.

- Investing in the Clarington Public Library, Museum and Archives to connect residents with cultural, literacy, heritage and learning resources.

What is an Operating Budget and a Capital Budget?

Operating Budget: Funds important municipal services that you rely on every day, such as fire and emergency services, local planning, recreation programs, animal services, libraries and more. The operating budget also includes the dedicated staff members who administer these services.

Capital Budget: Funds the assets and infrastructure that Clarington must invest in for the growth and well-being of the community. This includes building, repairing and replacing things like roads, parks and facilities.

Frequently Asked Questions

| How is Clarington's 2025 Budget Update going to affect my property tax bills? |

|

With Clarington’s 2025 Budget Update, the average household will see an approximate monthly increase of $7.78 (about $93 per year) for an average residential property. This represents a 1.76 per cent increase in the average overall property tax bill. Your tax bill is divided into three portions to deliver valuable services to residents:

The Region of Durham has increased its portion of property tax for 2025, resulting in an approximate monthly increase of $20 for an average residential property. This represents a 5.8 per cent increase in the average overall property tax bill. Learn more at durham.ca/budget. Compared to other nearby municipalities, Clarington has provided, and continues to provide, similar services at a significantly lower cost to the taxpayers. Clarington now, and historically, has had amongst the lowest property taxes in Durham Region. |

|

How does my MPAC assessment impact my taxes? |

|

Your MPAC assessment is just one of the factors used to calculate your property taxes. An increase or decrease in your property assessment doesn't necessarily mean your property tax will change in the same way. Property taxes are based on the budget needed to provide services and programs to Clarington residents. Market reassessment values don't create new revenue for the Municipality. Reassessment is considered revenue-neutral; as assessment values go up, tax rates are adjusted to ensure the Municipality only collects the amount of money it needs. This results in a shift in the share of the tax levy, as not all property values increase or decrease by the same percentage. The Province is currently reviewing property tax legislation and has indicated that reassessment continues to be deferred. Therefore, assessments will stay the same until at least the 2026 tax year. |

| How does the municipality prepare the budget? |

|

Clarington has four departments: Public Services, Legislative Services, Planning and Infrastructure Services, and Finance and Technology Services; the departments are overseen by the Chief Administrative Office. Each department prepares a budget for its area of responsibility, based on the past year's spending and forecasting costs for the coming year(s). They work to ensure that residents will enjoy either the same level of service, and in some cases, see enhanced services. The four-year budget was prepared concurrently with the 2024-27 Clarington Strategic Plan, which outlines the Municipality of Clarington’s priorities for the next four years. The Budget supports how we implement key action items identified in the Strategic Plan. |

| What is the operating budget? |

|

The operating budget outlines Clarington's spending plan for the day-to-day cost of the Municipality's programs and services, including fire services, programs, facilities, parks, arenas, road maintenance, staffing, utilities, libraries and much more. It is the equivalent of a household budget for groceries, gas, electricity, and insurance premiums. In Ontario, municipalities are required by the Municipal Act, 2001 to plan balanced operating budgets—meaning expenses must equal revenues every year and cannot borrow money to fund operating expenses. |

| What is the capital budget? |

|

The capital budget outlines significant expenditures on the acquisition and replacement of physical assets such as buildings, road repairs, bridges, and vehicles. The operating costs for these assets are included in the operating budget. In Ontario, municipalities can borrow some funds and run a deficit, within limits, to fund capital projects. For a household, the equivalent would be buying a new car or computer, or building an addition on the house. |

| How does Council decide on the budget? |

|

Under the Strong Mayors, Building Homes Act, 2022, the Mayor has a duty to propose the Municipality’s budget and present it to Council before February 1. The proposed budget is subject to Council amendments, a Mayoral veto, and a Council override process; each step is subject to a limited number of calendar days. After that has passed, the proposed budget is deemed to have been adopted by Council. A municipality can choose to prepare a budget covering one to five years. Clarington has prepared a four-year budget. To remain flexible and to adapt with changing needs, the budget will be reevaluated annually by Council. |

| If there is a budget surplus, where does the money go? |

| Legislation allows municipalities to allocate any surplus money at the end of each fiscal year to reserve funds. Clarington puts surplus funds in the Rate Stabilization Reserve Fund to offset any future deficits and help even out any tax rate increases. |

| How is my tax money spent? |

| Council sets out priorities through the budget, and tax dollars are spent on those items. Some of the priorities are fire protection, road maintenance and repair, parks, facilities, programs, libraries, municipal law enforcement, long-term capital projects, and much more. |

| How are home values assessed? |

|

The Municipal Property Assessment Corporation (MPAC) is responsible for assessing and classifying more than five million properties in Ontario. Every year, MPAC provides municipalities with an assessment roll to be used for taxation purposes. If you have questions about your assessment, call MPAC at 1-866-296-6722 or visit the MPAC website. For property-specific inquiries, visit the About My Property section to view information on your property, access your property assessment notice, and compare your property to others. If you disagree with your assessment, you can file a Request for Reconsideration (deadlines applicable). |

| How are my taxes calculated? |

| Your tax bill is calculated by multiplying your property's assessed value by the tax rates determined by the municipality, the Region of Durham, and province. Please see understanding your tax bill for more details. |

Contact Us